How to pass mortgage holiday as rent relief to tenants

14 Apr 2020Many a landlord in Britain will have lost some of their sources of income, and a recent survey claims that millions of renters will struggle to pay their rent in the forthcoming months.

For landlords on a mortgage, this poses a direct threat to the security of their asset, but fortunately, most banks have been quick to grant mortgage holidays for three months as default over a simple phone call. A mortgage holiday means that the instalments are paused, and the amount owed is either spread over the remaining term of the mortgage (thus affecting the monthly instalments once it resumes after the break) or it is simply added at the end of the mortgage term, thereby extending it for the time of the holiday.

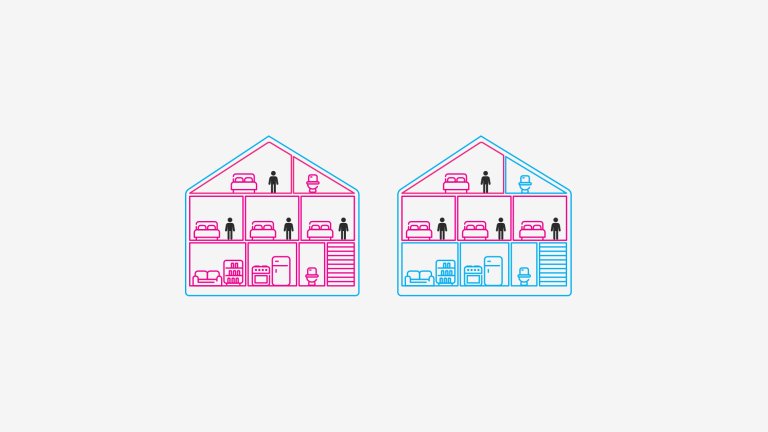

When a tenant is facing hardship and struggles to pay their rent, the landlord could get a mortgage holiday and pass it onto the tenant in the form of a rent break. Regrettably, the common practice is then for the landlord to ask the tenant to repay the rent holiday, which is seen as the right thing to do, as reported by Ben Beadle, the Chief Executive of the National Residential Landlord Association in this article.

Yet, this repayment expectation is conceptually wrong, because the terms of the mortgage and the terms of the tenancy agreement are incompatible. Mortgage terms extend over long periods of time -mostly decades- whereas most tenancies are periodic and can be ended with a month notice. When a tenancy finishes, its contractual obligations end with it, and by virtue of that attribute, we claim that the transfer of the debt to the tenant is unrealistic. It also is dangerous, illogical, and inappropriate; let’s see why.

Consider a landlord on a mortgage with a £1,000 monthly instalment and a break in Apr-Jun. His tenant pays £1,500 rent and is given a rent break in Apr-Jun as well. In July, the mortgage instalments resume for the landlord, and they could increase, decrease, or stay relatively unchanged. For a landlord on a fixed rate and/or with mortgage term near its expiry, the instalment might be £1,030, whereas, with a long mortgage term and a tracker rate, the instalment might be £980, owing to the decrease of the base rate of the Bank of England last March (for a more detailed analysis of the cost of mortgage holidays, check The Guardian). If you want to calculate this yourself, MoneySuperMarket has launched a mortgage holiday repayment calculator.

For the sake of simplicity, let's assume the cost of the mortgage break is compensated by the lower interest rate, and the instalment in July is unchanged at £1,000. In July, the tenant resumes paying £1,500 rent and the landlord negotiate a 6 months repayment term with the tenant, expecting them to repay £750 a month on top of their rent.

First and foremost, this repayment is unrealistic, because the burden of the rent is usually too high to expect the tenant to pay it back in the short term. As lettings professionals, we know that tenants able to afford a £1,500 rent will most probably struggle to pay £2,250 for 6 months, and we advise our landlords not to do this, because the risk is excessive.

Along the same lines, it has been stated by the Resolution Foundation that the accumulation of rent arrears will be detrimental to tenants, arguing that the issue will have to be solved through government intervention, as well as forbearance from landlords. We suggest that neither of this will be required (see the last title of this article).

Secondly, the expectation of repayment by the tenant is dangerous, because it will tighten the flexibility of the letting market altogether, thus creating a problem greater than the one it is trying to solve. The tenant who has lost their job may have to move house to get a new one, yet the rent owed could prevent them to do so. As the landlord has the right to claim rent arrears, the tenant may be compelled to stay, or they may agree to some sort of repayment plan, therefore crippling the tenant’s financial situation at best, or resulting in adverse credit rating at worst. The danger is that mounting rent arrears could prevent tenants from moving when they need it the most, precisely at the time when we must keep a flexible rental market to recover from the crisis.

Thirdly, it is illogical to claim the entire cost of the rent holiday to the current tenant, when the charge is actually spread over the whole term of the mortgage. Lenders will recover the mortgage break over the years left on the mortgage (possibly hundreds of instalments), whereas the tenant is expected to repay that in the short term, possibly over a few months. An example will help to illustrate this:

Imagine a hotel on the seaside, with 100 rooms, all rented for the night at £50 each. A tsunami wreaks havoc on the ground floor, which gets flooded and needs repairing. The hotel manager takes a loan of £2,500 repayable over one year, and wonders how to recover that money back. If he charges the cost of the bill to the 100 clients staying over that night, they would have to pay £75 instead of £50 i.e. a 50% increase. This is illogical, and not a single client will accept the deal readily. On the other hand, if the manager spreads the cost over the full year of the loan and increases the price of each room accordingly, he would get his money back seamlessly. Assuming a 50% occupation ratio over 365 nights, he'd need to increase the price to £50.14 per night (i.e. a 0.3% increase) to recover the £2,500. This way, the repairs are paid off, no one bears the brunt of the bill, and no one feels the impact of the measure. The same can be done with the rent, as explained below.

Last but not least, expecting the tenant to repay the mortgage holiday is also inappropriate, because it could mean for the cost of the break to be recovered twice. The spirit of the economic measures like the mortgage holiday and the interest rate drop-off is to make both landlords and tenants benefit from them. However, if the landlord claims the £4,500 rent break back to the tenant after July, they will have recovered the cost of their mortgage break twice: once via the rent arrears for Apr-Jun (£3,000 from the £4,500 they claim), and once via the rent starting July onwards, as these will already include the charge for the mortgage holiday repayment. This miscalculation would mean for the landlord to make £3,000 from the situation, thus pocketing the benefits of both economic measures, which is not their intended purpose.

So what to do with the missing rents, then?

If the tenant is facing hardship, increasing their burden with rent arrears is going to help neither the tenant nor the landlord, and the risk is greater for the landlord to lose that money in the end. To prevent this from happening, we argue that instead of passing the rent arrears onto a single tenant, it should be passed onto the tenancies instead (the current one and all the future ones to come), until the term of the mortgage is over. Just like the manager of the Seaside Hotel, we spread the cost of the break over the term of the mortgage, and pass this on through the rent charged from July onward. Landlords facing a £1,030 instalment in July could raise their rent to £1,530, whereas the landlord facing a £20 reduction could lower their rent accordingly.

This way, the mortgage holiday is passed onto the current tenants in the form of rent relief -without repayment conditions- to see them through the current crisis, and the landlord recoups the mortgage holiday via future rents.

As an agency, Rent Happily is fully supportive of rent reliefs for tenants facing hardship, and all our landlords who were eligible for mortgage holidays have passed it down to their tenants as a combination of rent reliefs and rent reductions, thereby avoiding any rent arrears. This way, our tenants don’t face rents they can’t afford, and they are free to move if they need to. Our landlords are reassured in the knowledge that their tenants are cared for, trusting that they will be able to pay their rent, and feeling safer about recovering the mortgage holidays in the long run.

All in all, this strategy helps strengthening the relationship between tenants and landlords, as well as supporting stable ongoing tenancies.

We hope to inspire others to think and act the same way.

Boris Drappier